User research - Product design - Documentation

Less than 20% of users activate digital cards right after verifying their accounts. This suggests there might be issues in the activation process that need fixing. Understanding why users aren't activating their cards can help improve the process and make it easier for them. This could lead to more users activating their cards and using them.

We saw that 85% of users who ordered physical cards didn't activate them, We were using Amplitude for tracking user behavior.

- Delivery time of physical card is long 7 days ~

- The activation process for the physical card is not clear

As the Product Designer on this transformative project, my responsibilities extended beyond design aesthetics. I was tasked with benchmarking best practices and exploring the latest user experience trends, all while spearheading the activation implementation plan.

We collect data from our support team on " How often do they receive support tickets for physical cards from users?"

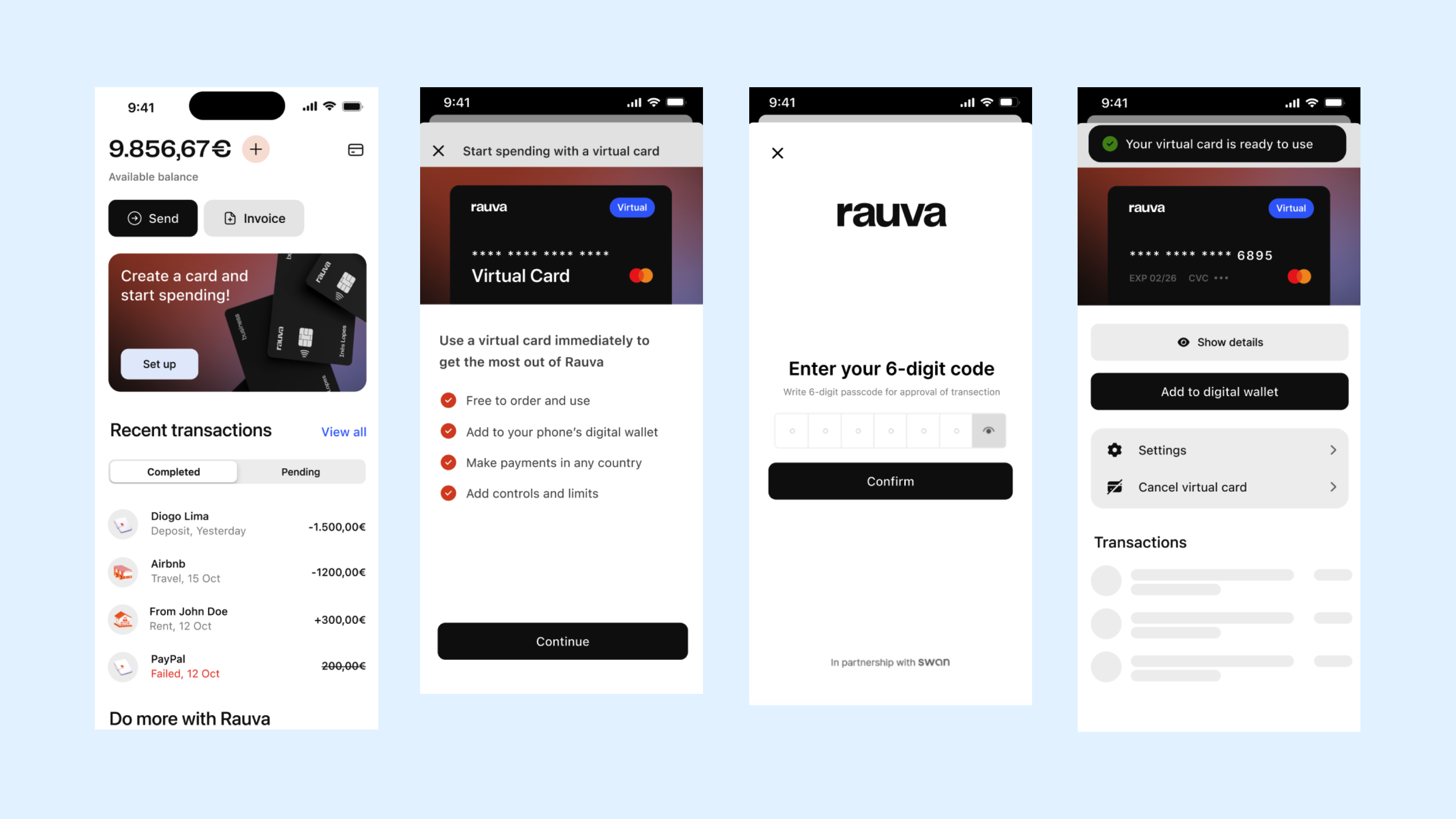

Physical card issuance is often accompanied by lengthy delivery times, resulting in a significant risk of customer attrition, by enabling users to create digital cards following Know Your Customer (KYC) and Know Your Business (KYB) verifications, they can start enjoying services almost immediately.

The hypothesis was that the 7-day delivery time for physical cards demotivated users, as Rauva was not their primary banking option, That led to a strategic pivot towards digital cards for immediate use. User interviews confirmed the need for faster access to card services. This insight directed the re-design of the user journey, emphasizing immediate digital card activation.

KPI’s

1- Increase card activation and Adoption conversion rate to 50%

2- Increase card spending total amount to 30%

Conversion rate at the end of 8 weeks since the project started:

Conversion surge 29% to 70%~

Spending amount at the end of 8 weeks since the project started:

Boost in user spending 1,500 Euro to 23,000 Euro weekly ~

Adoption rate at the end of 8 weeks since the project started:

The adoption rate increased from 6% to 23% ~